|

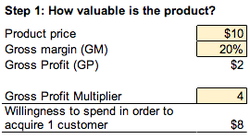

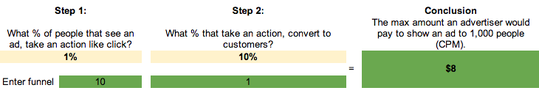

I built this quick and dirty model to calculate an advertisers' willingness to pay for an ad unit. This framework has come in handy as I think about TalkTo, so I wanted to share it. Please note that this a back-of-the-envelope calculation to "ballpark" Customer Lifetime Value (CLV). By understanding your customers' CLV (CCLV), you can understand willingness to pay for a new customer. And that willingness to pay is your revenue! I have a much more complex CLV model that I will clean and publish at a later date. Step 1: What is an advertiser (i.e. your customer) willing to pay to win a sale? The first step is to understand how valuable a new customer is to the advertiser. To do this, we must first understand the price and profit margin of the product(s) being advertised. Let's say, for example, the advertiser is CVS and they place an ad next to someone searching for sunscreen lotion. (It's a cold, dreary day in Cambridge so I'm dreaming a bit.) Let's say the sunscreen retails at $10 and that CVS's gross margin is 20%. Thus, CVS grosses $2 on that unit ($10 x 20%). Is $2 CVS's willingness to pay for this beach-goer? Close, but not quite. If CVS believes they will only capture this person one-time, then they will want to pay a fraction of $2. Paying any more means that they will lose money on the transaction. However, if sunscreen buyers typically buy 3 additional items for a total basket of goods valued at $40, CVS would be willing to pay up to $8 (4 units at $10 average with a 20% margin). Please note these are dummy numbers. I've set the model up so you can get to this number two ways. Since CVS expects a $40 basket of goods, simply plug in $40 of revenue. The other way to think about - and the preferred way to think about it - is to place a multiple on gross profit. In other words, CVS is willing to pay 4 times gross profit of $2, or $8. By using a multiplier, you can use a fraction of gross profit. Step 2: Calculating the advertisement rate Ok, so we've roughly calculated what your customer is willing to pay to acquire a customer. So meta. Now, we have to figure out how much the advertiser is willing to pay to show an ad to 1,000 people, i.e. CPM. Now, I know what you're saying: CPM is so 2002. You're right, but we are looking at this from the vantage-point of the platform owner -- think Facebook, Twitter, TalkTo. Thus, CPM is crucial because the platform has to attract and support those users. In other words, a platform cannot begin to think about advertising until it has several thousand "M." In the model, I take a two step approach by first asking "what percent of people see the ad and take an action" followed by "of those that take an action, how many convert to customers." This just gives you flexibility to think through the problem. Using the CVS example, let's say that 1% of people take an action and 10% of those convert to customers. Thus, 1 person in 1,000 converts to a customer WHICH means that CVS would be willing to pay up to $8 CPM. At $8, they break-even on variable costs; above $8 they lose money. Key Insights As you think about your customers' customer life time value, remember a few things.

0 Comments

Leave a Reply. |

JONATHAN STEIMAN

I'm the Founder and CEO of Peak Support. This blog is my take on early-stage companies and innovation. Every so often, there may be a post about culture, networking, family -- you name it. After all, what is a blog if it isn't a tad bit unstructured.

Archives

December 2016

Categories

All

|