|

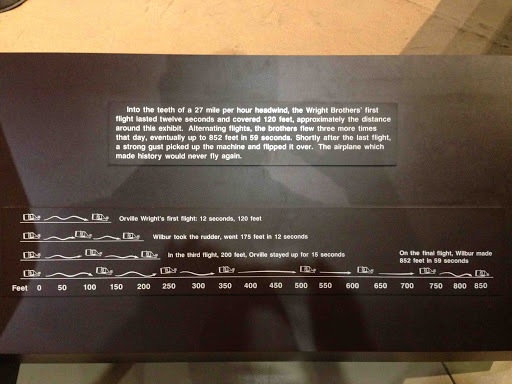

When I think about continuous improvement, I think about this small plaque at the EAA AirVenture Museum in OshKosh, WI.

In 1903, the Wright Brothers made the history books with the first "controlled, powered and sustained heavier-than-air human flight." Everyone celebrates the first flight, which was 40 yards in about 12 seconds. The most interesting aspect of the day is how much the Brothers improved. By the end of the day, they stayed in the air 59 seconds (391% improvement) and traveled 852 feet (610% improvement). In terms of speed, the first flight was 10 ft/second; the final flight of the day was 14 ft/second (40% improvement).

2 Comments

The best part about being in the start-up community is watching other start-ups. Almost every week, I learn about a new company that stops me in my tracks and makes me say, “Damn, that is so obvious. ABC company is going to forever change the way we do XYZ.” Here are three companies that have given me this reaction.

Kickstarter Venture capital was created 56 years ago. Before Eugene Kleiner’s shot-in-the-dark letter that landed on Arthur Rock’s desk, there was no institution for funding smart people with new ideas. That changed when Rock connected Kleiner and 7 other colleagues with Sherman Fairchild. Fairchild invested $1.5 million into the 8 transistor scientists to create Fairchild Semiconductor. Fairchild Semi was a success, at first, but soon the founders left because they did have enough equity. Two Fairchild employees - Robert Noyce and Gordon Moore - went on to found Intel. (To learn more about the fascinating history of VC and The Valley, check out this interview and the movie Something Ventured.) Venture capital was a tectonic innovation in finance. But in the last half century, not much has change: VCs raise money from Limited Partners and invest in young, un-established companies with mountains of potential. In fact, the major innovation has been the rise of secondary markets like SharesPost and SecondMarket. These exchanges give shareholders of private companies liquidity, which is great. But these markets have not changed the fundamental way in which early stage ideas get funded. The way that VC offered equity financing for early stage companies, Kickstarter offers working capital finance. This is huge. Before Kickstarter, working capital finance was restricted to established companies that had good relationships with banks. Now, a company with a novel product idea can create a Kickstarter campaign and pre-sell units. Since the company receives the money before shipping the product, they have capital on hand to deliver the promised product. In short, Kickstarter gives early stage entities a form of finance that did not previously exist for them. The key question is will Kickstarter launch a billion dollar business? Naysayers say no way; Kickstarter is for crafts and movies. I say, if Kickstarter was around in 1976, Jobs and Wozniak would have created the “Apple 1” campaign. TalkTo Look at the data. Texting is on the rise; voice calling is on the decline. Recognizing this, TalkTo created an app that allows anyone to text any question to any business. Want to know if Whole Foods has your favorite microbrew? Launch TalkTo, select Whole Foods, and shoot off a text. Running late for a dinner reservation? No worries; TalkTo has your back. I was in New York City this weekend and used TalkTo half a dozen times. It worked flawlessly. I was able to get a restaurant reservation, change said reservation, and double check that we would be seated outside. Within one day, TalkTo inserted itself between me and every business that I interact with. In other words, TalkTo -- not the restaurant, bank or hotel -- owns the relationship. This is incredibly powerful: owning the customer relationship is the holy grail in business. In the insurance industry, for example, brokers and underwriters constantly struggle to own the policyholder relationship. Owning the relationship enables companies to better understand customer needs and ensure quality interactions, leading to customers that stay longer and buy more. By building a simple app that delivers as promised, TalkTo is poised to change the way that people find information about and interact with companies. What company recently did that? I’ll give you a hint. It starts with a “G” and ends with an “oogle.” GigWalk I love services that create marketplaces. The two most recent examples are Airbnb and Uber. Airbnb looked at the world and said how can we connect supply (people with spare beds) with demand (people looking for an inexpensive place to stay). Uber did the same thing, connecting underutilized Town Cars with people seeking reliable and convenient car services. GigWalk is connecting businesses that need market research with people looking to make a few dollars. A brand - think Colgate, P&G, etc - needs to understand (or audit) how its products are being placed on the shelf at retailers. The brand could send in a dedicated “secret shopper,” which is costly and logistically challenging. Or, the brand could use GigWalk to push an alert to anyone in the area and ask them to simply take a photo of the Dental Section. I particularly like GigWalk because it is an everyday product. A simple trip the grocery store or Starbucks or a restaurant could net a GigWalker a few dollars. In short, GigWalk looked at the world and said how can we use existing tools to mobilize people to solve a business challenge. As 2011 comes to a close, I want to celebrate the blogs that caught my attention, made me think, and taught me a lesson or two. So without further adieu, I present my favorite 5 blogs of 2011. The Sincerest Form of Flattery, by Matt Brezina, CEO of Sincerely When Apple launched Cards, an app for sending physical cards, my heart sank. My close friend of more than 10 years had just launched Sincerely and its flagship product Postagram. Apple entered the exact market my friend Matt was creating. Before turning in for the night, I checked Twitter one more time and saw that Matt posted this blog. I read it. By the end of the post, I realized Sincerely wasn’t scared of the competition; on the contrary, it was energized by it. So, if you’re running a company and a bigger competitor enters your space, use the opportunity to change the conversation. This post does three things particularly well.

4. Secrets aren’t necessary What Powers Instagram: Hundreds of Instances, Dozens of Technologies by Instagram Companies are secretive. Coca-cola locks its recipe in a safe. Apple goes to extraordinary lengths to veil new products. It refreshing, therefore, when a company comes out and says, “Hey, this is how we do things.” And no company did this better than Instagram, the photo sharing mobile app that launched this year and already has more than 12 million users. In this blog post, Instragram shares its IT strategy. Anyone interested in launching a competitive product could – and should – follow each and every recommendation. And that is the point: when you have a branded product that consumers trust – in Warren Buffett’s terms a “moat” – it does not matter if your competitors or customers know how the product gets delivered. Having the exact recipe or a head-start on a new product does not make it any more likely that Coke or Apple will be disrupted. The same goes for Instagram. Understanding how Instagram delivers beautiful photos to your mobile devices does not mean a competitor can replace them through replication. A new competitor needs to identify what Instagram is missing and then fill that customer need. 3. IPOs and private markets IT'S OFFICIAL: The IPO Market Is Crippled -- And It's Hurting Our Country by Alan Patricof A major story throughout 2011 was Facebook’s valuation on the private markets. As of September, the company was valued at $82 billion on SharePost. But there was a bigger story than just the billions Facebook was worth. If a global brand with profits and exponential growth had not already gone public, what did that say about the IPO market overall? In a blog on Business Insider, Greycroft’s Alan Patricof poured onto the page the knowledge he has gained from over 30 years of early stage investing. He concluded that companies, particularly smaller ones, no longer have the opportunity to go public and as a result America is losing its technological advantage. The decline in the IPO market is the result of four factors:

2. Added to my lexicon in 2011: “Napkin Entrepreneur” Napkin Entrepreneurs by Steve Blank I judge a blog based on how often I reference it in my daily life. This year, I added a new phrase to my lexicon: Napkin Entrepreneur. Steve Blank, a start-up veteran and thought leader, wrote a perfect summary of today’s start-up environment. Basically, the amount of capital required to start a business has fallen dramatically while the number customers you can reach has risen dramatically. As a result, dreamers no longer need to sketch out a plan on a cocktail napkin. Rather, they can hack the product together and deliver it to millions of users at zero cost. If the feedback is positive, keep going. If it is negative, move onto the next idea. The Napkin has been replaced with the beta product. 1. Don't worry about Marauders Speech by Elizabeth Warren, Senate candidate in Massachusetts (Starts at 00:48) Last summer I took a class at NYU Stern that forever changed my perspective. The class was called Global Perspectives on Enterprise Systems and it was taught by Robert Wright. The goal of the class was to understand why some countries develop rapidly, like the United States, while others do not develop at all. It came down to the “Growth Diamond;” Stern professors notoriously love baseball. Home plate is a non-predatory, Lockean government. In other words, growth starts with a government that protects the life, liberty and property of its citizens. Such a government collects taxes transparently, regularly and at a reasonable rate. The government also establishes and enforces reasonable laws. Note that such a government does not need to be a democracy; though they often are. The next phase of development, or first base, is a financial system in which capital moves from savers to borrowers. First base cannot be reached without home plate; after all, the crux of saving and lending are contracts recognized by the courts established by the government. With home plate and first base established, the economy is prepared to take second base: entrepreneurship. Individual actors are comfortable investing into a long-term business knowing that the government will not pilfer it in the night. And even if something goes wrong, the actor has faith that the slip of paper called “insurance” will be made good. And lastly, the actor has access to capital, thanks to first base. Interestingly, not all economies move equally between bases. There are countries with non-predatory governments and financial systems that have less entrepreneurship than others. The final stage, third base, is a management system. Basically, the entrepreneurs that flourished from a stable government and access to capital eventually grow into large, distributed organizations. These organizations have the systems required to undertake large and complex markets like air travel, chip fabrication and automobile manufacturing. So what does this have to do with Elizabeth Warren? Simple. She understands the Growth Diamond, and more than anything she can articulate it to the American people. This speech lit-up the blogosphere and belongs in the annals of great speeches made by great Americans. Today's Wall Street Journal celebrated the life of Ted Fortsmann. Fortsmann was one of the founding fathers of private equity and a prominent 'character' in "Barbarians at the Gate," a must-read about the RJR Nabisco buyout.

I'm writing about Fortsmann because his firm perfectly summarized what it means to be an entrepreneur. According to the Journal, Fortsmann Little gave their guests at a 25th Anniversary celebration a silver platter engraved with the following: "The entrepreneur, as a creator of the new and a destroyer of the old, is constantly in conflict with convention. He inhabits a world where belief precedes results, and where the best possibilities are usually invisible to others. His world is dominated by denial, rejection, difficulty, and doubt. And although as an innovator, he is unceasingly imitated when successful, he always remains an outsider to the 'establishment.'" This quote perfectly captures entrepreneurship. The opening line - "creator of new and destroyer of the old" - details the phenomena of creative destruction. The second sentence captures the imaginative nature of entrepreneurs; I'm immediately reminded of Steve Jobs who envisioned a world in which every person would have a computer in light of the day's leading tech firms (HP, IBM, Xerox) telling him the computer was a business tool. The third sentence encapsulates the difficult path entrepreneurs traverse. Examples of struggles are bountiful, but my favorite is the Music Genome Project; before pivoting to become Pandora, the company burned through its cash and asked employees to take no pay for a year. The final sentence is interesting. The imitator effect has a positive but hard to measure impact on the economy. The success of one entrepreneur motivates thousands to strike out on their own to seek opportunities "usually invisible to others." Prior entrepreneurial successes, in other words, signal to current would-be entrepreneurs that the system works. One person in the new class of entrepreneurs then realizes wild success and the cycle repeats itself. If Steve Jobs and Bill Gates were stripped of their wealth or thrown in prison for challenging the statues quo, would Larry and Sergey have been motivated to start Google? And if Larry and Sergey were not able to capture the value they created, would Mark Zuckerberg have been motivated enough to create Facebook? A couple weeks ago, I headed into the backcountry of Banff National Park for a 5 day, 40-mile hike. This was my fourth major hike since 2004, and perhaps the most grueling due to the weather. Eight hours into the hike, the skies opened and did not close until the final morning. So as I slogged through the mud, trying not to step on Grizzly Bear paw prints, I asked myself: why am I schlepping a sixty-pound backpack in cold, driving rain and at the risk of a fatal attack by 500-pound mammal?

One reason is that hiking provides an opportunity to see different aspects of life in new ways. During this trip, I realized that backpacking is a lot like launching a startup. Below, in no particular order, are the reasons why. Limited resources fuels innovation A hiker’s resources are limited to what he can carry (tent, sleeping bag, clothes) and what the forest provides (wood, water). If you forget – or lose – something, it is gone and you better hope that you don’t need it. After a few days of living with such constraints, the mind becomes incredibly inventive. During this trip, for example, we rigged up a sturdy multi-level clothes-drying rack using nothing but branches and logs. During a past trip, we crafted a way to drag our packs across snowfields in order to limit falling through. All businesses but especially start-ups are resource limited. Capital, talent, and time are in short order. As a result, start-ups constantly innovate not only in the products they offer but in the way they operate. My favorite story of innovating to survive is Airbnb, which designed Obama O’s cereal and sold the collector-edition munchies to attendees at the Democratic National Convention. They raised $25,000 to fund their start-up. As start-ups mature, however, they must shed the patchwork operations that they "innovated" during the lean years. Relying too heavily on Excel – or Google Docs – is a prime example. When resources are limited, it is acceptable to cram everything from salary planning to project management into a spreadsheet. As the company proves longevity, it must invest in the proper processes and technologies in order to support sustainable growth. Not doing so is equivalent to using an open fire and rack of branches to dry clothes, despite being out of the woods and having access to an electric dryer. Risk management takes on a whole new meaning Hiking is a risky endeavor. Any number of events can happen on the trail, including getting lost, injuring yourself, running into an aggressive animal or getting hit with a major weather event. These events can easily result in death – and it is usually a slow and agonizing death. But they are all avoidable. With the correct maps and trail descriptions and an ability to read a compass, the risk of getting lost is greatly diminished. (Heck, you can even bring a GPS that pinpoints your exact location, but that takes the fun out of it.) Talking on the trail and hanging your food 100-plus meters away from your tent are both actions that reduce the threat of a bear attack. Throw in bear spray and a general understanding of what to do in the event of an encounter and you’re in pretty good shape. Lastly, reducing injury is common sense: never jump; be careful with your knife and around the fire; stay hydrated, dry and warm; carry a first aid kit. Risk management is dependent upon understanding the probability and severity of an event occurring. Once you understand these two factors, you can triage mitigation. As I walk through the woods, I’m constantly calculating and triage-ing. During this trip, for example, I calculated the risk of a bear encounter to be moderately high; by my calculations there was one Grizzly for every 10 square miles of habitable land, and we were traversing 40 miles. On the other hand, the risk of getting lost was low; the trail was through a valley with steep, rocky mountain faces on each side – the equivalent of bumpers on a bowling alley lane. I adjusted my behavior accordingly. For start-ups, risks lurk around every corner: system outages, patent trolls, legislatures, unethical employees. A founder’s job is to identify, triage and manage these risks. Unfortunately, though, risk management is often sidelined during the frenzy of creating a new product and winning customers. After all, it is difficult to pull oneself away from the exhilarating and vital task of crafting the next generation of a product to draft a contingency plan that may never be used. Founders also have a difficult time shifting money away from R&D and sales and towards risk management expenses like insurance, lawyers, and monitoring systems. Remember how fortunate you are Hiking helps remind me how fortunate I am. I have my legs to carry me, my eyes to take in the vistas and my ears to hear the sounds of rushing mountain waters and high-pass winds. I have also chosen to live a “pre-civilization” lifestyle by sleeping on the ground in a flimsy shelter, pumping water, keeping warm and cooking with fire, and placing myself lower on the food chain. For millions of people this is not a lifestyle choice; 884 million people, for example, do not have access to clean water. Lastly, I’m reminded of the military, who basically hike through the most treacherous places on earth – from the mountains of Afghanistan to the jungles of Vietnam – with one additional risk: enemy fire. Start-up founders are also fortunate. In many ways, founders are responsible for their destiny. They envision an opportunity and have the courage and talent to execute upon that vision. However, there are factors outside of their control that increase the likelihood of success. Health and physical appearance is one example. Success is also dependent on origin of birth and residency. Over the last 400 years, the United States has developed systems and institutions that foster entrepreneurship. In the United States it takes 6 days and only a few hundred dollars to establish a legal corporate entity, whereas in Brazil it is four month journey that could cost more than one thousand dollars. Throw in bankruptcy laws that do not discourage risk taking, a court system that upholds property rights and legal contracts and a functioning insurance market, and innovation flourishes. In short, an entrepreneur operating in the United States has a much greater chance of success than his equally talented counterpart in just about any other part of the world. Stayed tuned to hear the insights from Hike 2012, which will hopefully be in Glacier National. Yesterday, Steve Blank of Stanford University wrote an excellent blog entitled Napkin Entrepreneurs. First, he noted that the barriers to starting a web or mobile application have been dramatically reduced. The crux of the blog, though, was that the back of the envelope idea has evolved to the point where you can quickly develop and test it in the market.

Blank writes: "One of the amazing consequences of the low cost of creating web and mobile apps is that you can get a lot of them up and running simultaneously and affordably. I call these app development projects “science experiments.” These web science experiments are the logical extension of the Customer Discovery step in the Customer Development process. They’re a great way to brainstorm outside the building, getting real customer feedback as you think through your ideas about value proposition/customer/demand creation/revenue model. They’re the 21st century version of a product sketch on a back of napkin." I could not agree more with Blank. In fact, my very first blog on this website was about this topic. I just have one critique of the blog. Blank uses the word founder and entrepreneur interchangeably. It's a pet-peeve of mine. The word “entrepreneur” is often mis- and over-used. If a person quits their job to bring an idea to light, than by all means they are a “founder.” But founder does not equate to entrepreneur. I find Peter Drucker’s definition in Innovation and Entrepreneurship the best: “The husband and wife who open another delicatessen or another Mexican restaurant in the American suburb surely take a risk. But are they entrepreneurs? All they do is what has been done many times before. They gamble on the increasing popularity of eating out in the area, but create neither a new satisfaction nor new customer demand. Seen under this perspective they are surely not entrepreneurs even though theirs is a new venture. McDonald’s, however, was entrepreneurship. It did not invent anything, to be sure. Its final product was what any decent American restaurant had produced years ago. But by applying management concepts and management techniques (asking, What is the ‘value’ to the customer?), standardizing ‘products’, designing processes and tools, and by basing training on the analysis of work to be done and then setting the standards it required, McDonald’s both drastically upgraded the yield from resources, created a new market and a new customer. This is entrepreneurship.” So the person who quits their job to create another coupon service or to digitize a previously invented game (think Scrabulous) is a founder and a go-getter, but not necessarily an entrepreneur. The term entrepreneur is reserved for the person or company reinventing the way coupons are bought and marketed or the person creating all new games, such as what is happening in the location-based space. I spent this past President's Day weekend with my family in Massachusetts. For the last few months, I've been reflecting on entrepreneurship and innovation, and have drawn the following conclusion: It's a golden era. Just when you think there won't be another blockbuster, two-year old Groupon tells Google to take its $6 billion and scram. I was surprised, therefore, to hear my family's dismal, pessimistic outlook. Why the disconnect? Is it because my father had not been reading TechCrunch, but rather the local news which focused on the housing market and retirement funds duped by Bernie Madoff? Or are we in a social/mobile/local bubble that is impairing my judgement?

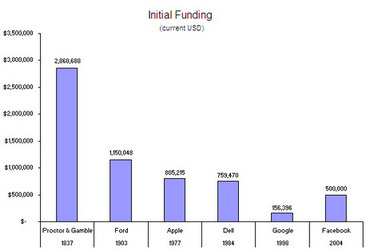

While I concede that the market may be a bit frothy, my conclusion largely stands: Entrepreneurship and innovation in the US is thriving. Thanks to cheap computing power, open source software, low cost telecommunications and digital distribution channels, the capital required to start a successful business is a fraction of what it was 5, 10 or 100 years ago. In 1837, Proctor & Gamble required an initial funding of over $7,000, which equates to $2.8 million today. Fast forward to the current millennium and Facebook, Google and the other great companies of our generation were all initially capitalized with a fraction of $2 million (see below chart). Furthermore, today's businesses scale much quicker. Facebook, for example, reached $2 billion in sales less than 6 years after its creation, an amazing feat considering that the company did not have a revenue model in the early years. Dell, on the other hand, had a clear revenue model and it took almost 10 years to reach the $2 billion mark. Media is another great example of scale. At its peak, the New York Times had a daily circulation of about 1.2 million. Today, Justin Bieber sends unlimited messages at no cost to 7 million followers on Twitter. The combination of low capital requirements and achieving scale quickly is having two effects on entrepreneurship. First, lower capital requirements means that a greater number of companies can become viable businesses with personal savings, friends and family money or angels. This is great for the founders because they are able to improve their company's valuation ahead of a traditional VC round. It's also giving rise to "super angels," or investors that are more flexible than old-line VC firms but more sophisticated than the traditional angel / accredited investor. Second, quick scale means more instant feedback on a company or a product. In the past, products were delivered through disconnected channels and advertisements were one-way. As a result, the feedback loop spanned many months and often did not provide great insights. Today, a company can receive instant feedback on a product, thus allowing it to quickly adjust its offering or messaging. Capital requirements will continue to fall and companies will continue to achieve scale at an accelerated pace. This maxim provides me great comfort. I would, however, be naive if I did not see the structural problems facing this nation. Our indebtedness, our educational system and our immigration policy are worrying. If we fail to address those issues, the very entrepreneurial landscape that I laid out above will be at risk. But those are topics for another day. Today, I'm going to visit an Apple store and soak in the wonders of today's innovations. |

JONATHAN STEIMAN

I'm the Founder and CEO of Peak Support. This blog is my take on early-stage companies and innovation. Every so often, there may be a post about culture, networking, family -- you name it. After all, what is a blog if it isn't a tad bit unstructured.

Archives

December 2016

Categories

All

|