|

According to recent reports, the SEC is reviewing the regulations surrounding investments in privately held companies. The agency is believed to be reviewing the rule that caps the number of investors in a private company at 499. This arbitrary number, say its critics, is outdated in the in the age of crowd-sourcing. Another area that I believe is in desperate need of review is Regulation D Rule 501, which states that an individual can only invest in a privately held company if they have:

Unfortunately, I know this story all too well. A few years ago, a family member of mine invested $50,000 into a privately-held company. The family member was a single mother that had major health issues and was therefore unable to keep steady work. When she passed away, leaving behind a 12-year-old daughter, we discovered that she did a lease-back on her property and was advised by someone close to her to invest the money with his employer, an India-based outsourcing start-up. The accredited investor rule can help prevent this from happening. Unfortunately, it also hurts economic growth by hindering entrepreneurship and limiting investment opportunities for individuals with a relatively low net worth. From the entrepreneur’s standpoint, the accredited investor rule lowers the probability of raising capital and getting an early stage venture off the ground.** The accredited investor rules are also regressive, meaning that those with money get the opportunity to participate in high-risk, high-return ventures, while the general population is unable to participate in the funding the next Microsoft, Google or Facebook. Obviously, these type of ventures are not suitable for every investor; a single mother with a low paying job and health problems, for example. But it makes little sense that a young person with a healthy salary and the technology savvy to understand future markets should be relegated to the sidelines. Furthermore, even if this person loses their investment, which is the most likely outcome, they will have learned a tremendous amount. No regulation is perfect. However, I would like to see these rules updated to capture the realities of today. Some headway is being made, given that the SEC is at least reviewing the rules. Perhaps, unaccredited investors should be allowed to invest up to $10,000 or $20,000. Or, they could be permitted to participate only after maxing out a Roth IRA and / or contributing at least 8% to their 401k / 403b accounts. ________________________________________________ Please note that I am not a lawyer; so please follow the links in this blog to the SEC rules and, if need be, consult an attorney. In the past, I have reached out to Ryan Roberts who writes the startuplawyer blog and Bart Greenberg who is at Haynes and Boone and also active on Quora. They have both been responsive and helpful. *There are ways around this; for example, Reg 506 allows for companies to raise money from 35 non-accredited investors. However, this rule can be undone by state laws; New York and California are among the strictest. Please note that I’m not a lawyer; for more information follow the links. Also, there are discussions about excluding primary **Also, less available capital shifts the pricing power to investors and thus increases the cost of capital. I have not seen any empirical evidence to support this point, but I have a hunch that a change in regulations that doubled the number of people able to invest $10,000 would increase valuations, at least in the short-term. It is still up to the founder to create value regardless of the accredited investor rules.

0 Comments

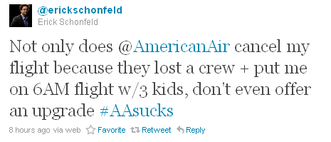

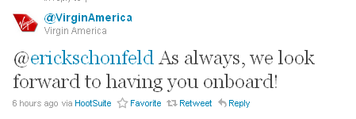

Earlier today, Erick Schonfeld was delayed by American Airlines. He took his frustration to Twitter, posting the following tweet. Within a few minutes, American Airlines responded to Erick's disparaging tweet. Makes sense. Erick is the editor of TechCrunch and followed by 31,000 people. In other words, Erick is an "influencer." Overall, AA's responses is an impressive example of how companies need to operate in the Web 2.0 age. However, Virgin America wins this battle. Virgin America proactively followed with the below tweet.

|

JONATHAN STEIMAN

I'm the Founder and CEO of Peak Support. This blog is my take on early-stage companies and innovation. Every so often, there may be a post about culture, networking, family -- you name it. After all, what is a blog if it isn't a tad bit unstructured.

Archives

December 2016

Categories

All

|