|

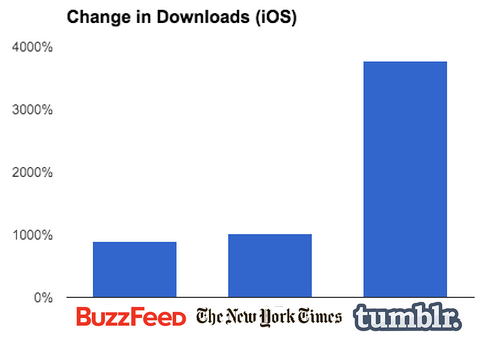

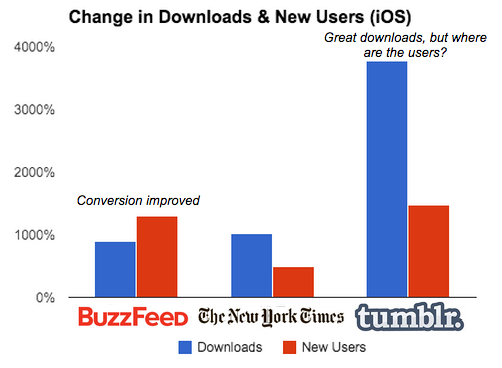

Every start-up dreams about being mentioned in The New York Times. A dash of NY Times ink provides credibility to your idea and drives usage, or so the logic goes. But in today's rapidly changing media landscape, does this still hold true? Based on my experience with TalkTo, the answer is a resounding NO. In fact, even large websites like BuzzFeed may not provide a huge boost to your business. The holy grail of driving traffic: raving fans writing genuine reviews for a small but passionate readership. I came to this conclusion by comparing how press coverage from three outlets improved our average daily iOS downloads. I looked at daily downloads 5 days prior to each article and 5 days after each article. TalkTo, which was acquired by Path in June, has been covered by many of the major publications but for this study I looked at mentions in The New York Times (Old Media), BuzzFeed (New Media), and Tumblr (Social Media). A Tumblr blog posted by an angsty 20-something from Canada named HeyitsJnnfr increased downloads by a factor of 38; in other words, if we got 1 download prior to the blog, we got 38 the following week. Jennifer nailed a particular use-case: "people who suffer from social anxiety where telephone communications might be triggering or uncomfortable." This message resonated with her 2,500 followers who started to like and reblog the post. As of today, this obscure blog has been shared by 89,000 people. In comparison, BuzzFeed, with 1.41 million Twitter followers and 3.8 million Facebook likes, drove a 10X increase in downloads. The New York Times (13 million Twitter, 8.5 million Facebook) drove slightly more downloads than BuzzFeed and but far fewer than Heyitsjnnfr's post. Downloads are only half of the battle. The other key element is conversion, i.e. the number of people that download, open and use the app. In this metric, BuzzFeed was the best. As you can see from the chart below, the 5-day before/after change in BuzzFeed New Users outpaced downloads. Tumblr, on the other hand, was pretty abysmal: A 38X increase in new users only yielded a 16X increase in New Users. The New York Times was similar to Tumblr. Key Take Aways

6 Comments

The best part about being in the start-up community is watching other start-ups. Almost every week, I learn about a new company that stops me in my tracks and makes me say, “Damn, that is so obvious. ABC company is going to forever change the way we do XYZ.” Here are three companies that have given me this reaction.

Kickstarter Venture capital was created 56 years ago. Before Eugene Kleiner’s shot-in-the-dark letter that landed on Arthur Rock’s desk, there was no institution for funding smart people with new ideas. That changed when Rock connected Kleiner and 7 other colleagues with Sherman Fairchild. Fairchild invested $1.5 million into the 8 transistor scientists to create Fairchild Semiconductor. Fairchild Semi was a success, at first, but soon the founders left because they did have enough equity. Two Fairchild employees - Robert Noyce and Gordon Moore - went on to found Intel. (To learn more about the fascinating history of VC and The Valley, check out this interview and the movie Something Ventured.) Venture capital was a tectonic innovation in finance. But in the last half century, not much has change: VCs raise money from Limited Partners and invest in young, un-established companies with mountains of potential. In fact, the major innovation has been the rise of secondary markets like SharesPost and SecondMarket. These exchanges give shareholders of private companies liquidity, which is great. But these markets have not changed the fundamental way in which early stage ideas get funded. The way that VC offered equity financing for early stage companies, Kickstarter offers working capital finance. This is huge. Before Kickstarter, working capital finance was restricted to established companies that had good relationships with banks. Now, a company with a novel product idea can create a Kickstarter campaign and pre-sell units. Since the company receives the money before shipping the product, they have capital on hand to deliver the promised product. In short, Kickstarter gives early stage entities a form of finance that did not previously exist for them. The key question is will Kickstarter launch a billion dollar business? Naysayers say no way; Kickstarter is for crafts and movies. I say, if Kickstarter was around in 1976, Jobs and Wozniak would have created the “Apple 1” campaign. TalkTo Look at the data. Texting is on the rise; voice calling is on the decline. Recognizing this, TalkTo created an app that allows anyone to text any question to any business. Want to know if Whole Foods has your favorite microbrew? Launch TalkTo, select Whole Foods, and shoot off a text. Running late for a dinner reservation? No worries; TalkTo has your back. I was in New York City this weekend and used TalkTo half a dozen times. It worked flawlessly. I was able to get a restaurant reservation, change said reservation, and double check that we would be seated outside. Within one day, TalkTo inserted itself between me and every business that I interact with. In other words, TalkTo -- not the restaurant, bank or hotel -- owns the relationship. This is incredibly powerful: owning the customer relationship is the holy grail in business. In the insurance industry, for example, brokers and underwriters constantly struggle to own the policyholder relationship. Owning the relationship enables companies to better understand customer needs and ensure quality interactions, leading to customers that stay longer and buy more. By building a simple app that delivers as promised, TalkTo is poised to change the way that people find information about and interact with companies. What company recently did that? I’ll give you a hint. It starts with a “G” and ends with an “oogle.” GigWalk I love services that create marketplaces. The two most recent examples are Airbnb and Uber. Airbnb looked at the world and said how can we connect supply (people with spare beds) with demand (people looking for an inexpensive place to stay). Uber did the same thing, connecting underutilized Town Cars with people seeking reliable and convenient car services. GigWalk is connecting businesses that need market research with people looking to make a few dollars. A brand - think Colgate, P&G, etc - needs to understand (or audit) how its products are being placed on the shelf at retailers. The brand could send in a dedicated “secret shopper,” which is costly and logistically challenging. Or, the brand could use GigWalk to push an alert to anyone in the area and ask them to simply take a photo of the Dental Section. I particularly like GigWalk because it is an everyday product. A simple trip the grocery store or Starbucks or a restaurant could net a GigWalker a few dollars. In short, GigWalk looked at the world and said how can we use existing tools to mobilize people to solve a business challenge. Today's Wall Street Journal celebrated the life of Ted Fortsmann. Fortsmann was one of the founding fathers of private equity and a prominent 'character' in "Barbarians at the Gate," a must-read about the RJR Nabisco buyout.

I'm writing about Fortsmann because his firm perfectly summarized what it means to be an entrepreneur. According to the Journal, Fortsmann Little gave their guests at a 25th Anniversary celebration a silver platter engraved with the following: "The entrepreneur, as a creator of the new and a destroyer of the old, is constantly in conflict with convention. He inhabits a world where belief precedes results, and where the best possibilities are usually invisible to others. His world is dominated by denial, rejection, difficulty, and doubt. And although as an innovator, he is unceasingly imitated when successful, he always remains an outsider to the 'establishment.'" This quote perfectly captures entrepreneurship. The opening line - "creator of new and destroyer of the old" - details the phenomena of creative destruction. The second sentence captures the imaginative nature of entrepreneurs; I'm immediately reminded of Steve Jobs who envisioned a world in which every person would have a computer in light of the day's leading tech firms (HP, IBM, Xerox) telling him the computer was a business tool. The third sentence encapsulates the difficult path entrepreneurs traverse. Examples of struggles are bountiful, but my favorite is the Music Genome Project; before pivoting to become Pandora, the company burned through its cash and asked employees to take no pay for a year. The final sentence is interesting. The imitator effect has a positive but hard to measure impact on the economy. The success of one entrepreneur motivates thousands to strike out on their own to seek opportunities "usually invisible to others." Prior entrepreneurial successes, in other words, signal to current would-be entrepreneurs that the system works. One person in the new class of entrepreneurs then realizes wild success and the cycle repeats itself. If Steve Jobs and Bill Gates were stripped of their wealth or thrown in prison for challenging the statues quo, would Larry and Sergey have been motivated to start Google? And if Larry and Sergey were not able to capture the value they created, would Mark Zuckerberg have been motivated enough to create Facebook? |

JONATHAN STEIMAN

I'm the Founder and CEO of Peak Support. This blog is my take on early-stage companies and innovation. Every so often, there may be a post about culture, networking, family -- you name it. After all, what is a blog if it isn't a tad bit unstructured.

Archives

December 2016

Categories

All

|