|

The best part about being in the start-up community is watching other start-ups. Almost every week, I learn about a new company that stops me in my tracks and makes me say, “Damn, that is so obvious. ABC company is going to forever change the way we do XYZ.” Here are three companies that have given me this reaction.

Kickstarter Venture capital was created 56 years ago. Before Eugene Kleiner’s shot-in-the-dark letter that landed on Arthur Rock’s desk, there was no institution for funding smart people with new ideas. That changed when Rock connected Kleiner and 7 other colleagues with Sherman Fairchild. Fairchild invested $1.5 million into the 8 transistor scientists to create Fairchild Semiconductor. Fairchild Semi was a success, at first, but soon the founders left because they did have enough equity. Two Fairchild employees - Robert Noyce and Gordon Moore - went on to found Intel. (To learn more about the fascinating history of VC and The Valley, check out this interview and the movie Something Ventured.) Venture capital was a tectonic innovation in finance. But in the last half century, not much has change: VCs raise money from Limited Partners and invest in young, un-established companies with mountains of potential. In fact, the major innovation has been the rise of secondary markets like SharesPost and SecondMarket. These exchanges give shareholders of private companies liquidity, which is great. But these markets have not changed the fundamental way in which early stage ideas get funded. The way that VC offered equity financing for early stage companies, Kickstarter offers working capital finance. This is huge. Before Kickstarter, working capital finance was restricted to established companies that had good relationships with banks. Now, a company with a novel product idea can create a Kickstarter campaign and pre-sell units. Since the company receives the money before shipping the product, they have capital on hand to deliver the promised product. In short, Kickstarter gives early stage entities a form of finance that did not previously exist for them. The key question is will Kickstarter launch a billion dollar business? Naysayers say no way; Kickstarter is for crafts and movies. I say, if Kickstarter was around in 1976, Jobs and Wozniak would have created the “Apple 1” campaign. TalkTo Look at the data. Texting is on the rise; voice calling is on the decline. Recognizing this, TalkTo created an app that allows anyone to text any question to any business. Want to know if Whole Foods has your favorite microbrew? Launch TalkTo, select Whole Foods, and shoot off a text. Running late for a dinner reservation? No worries; TalkTo has your back. I was in New York City this weekend and used TalkTo half a dozen times. It worked flawlessly. I was able to get a restaurant reservation, change said reservation, and double check that we would be seated outside. Within one day, TalkTo inserted itself between me and every business that I interact with. In other words, TalkTo -- not the restaurant, bank or hotel -- owns the relationship. This is incredibly powerful: owning the customer relationship is the holy grail in business. In the insurance industry, for example, brokers and underwriters constantly struggle to own the policyholder relationship. Owning the relationship enables companies to better understand customer needs and ensure quality interactions, leading to customers that stay longer and buy more. By building a simple app that delivers as promised, TalkTo is poised to change the way that people find information about and interact with companies. What company recently did that? I’ll give you a hint. It starts with a “G” and ends with an “oogle.” GigWalk I love services that create marketplaces. The two most recent examples are Airbnb and Uber. Airbnb looked at the world and said how can we connect supply (people with spare beds) with demand (people looking for an inexpensive place to stay). Uber did the same thing, connecting underutilized Town Cars with people seeking reliable and convenient car services. GigWalk is connecting businesses that need market research with people looking to make a few dollars. A brand - think Colgate, P&G, etc - needs to understand (or audit) how its products are being placed on the shelf at retailers. The brand could send in a dedicated “secret shopper,” which is costly and logistically challenging. Or, the brand could use GigWalk to push an alert to anyone in the area and ask them to simply take a photo of the Dental Section. I particularly like GigWalk because it is an everyday product. A simple trip the grocery store or Starbucks or a restaurant could net a GigWalker a few dollars. In short, GigWalk looked at the world and said how can we use existing tools to mobilize people to solve a business challenge.

11 Comments

Congratulations, your start-up received a term-sheet. Now what? If you’re a first time entrepreneur, you’ve been pounding the pavement for months – maybe even years – and a term sheet puts you one small step closer to funding. So, first, enjoy the moment. I know the feeling. Back in 2005, I landed my first sheet for a healthcare retail start-up I was working on. I remember thinking: This is it! Where do I sign? But don’t let the celebration last too long. You’ve got some analysis to do. The first step is building a pay-off diagram. A term sheet lays out the rules for splitting the spoils if and when your company has an exit event, such as a merger, IPO or liquidation. Thus, a pay-off diagram graphically shows what you get and what your investors get given different exit amounts. There are so many variables that go into a pay-off diagram, but I’ve built a model that covers the vast majority of early-stage term sheets. I’ve made it available as a Google Doc Template and you can access it here: There are other models out there, and I suggest you play with those too. Andrew Metrick and Ayako Yasuda have a great tool that allows you to model pay-offs across several rounds. Their model, however, is geared toward the VC investor more than the entrepreneur. Before you dive in, I’ll walk you through the basics. We’ll also look at a few examples. The Variables First, chose the type of security (cell B7):

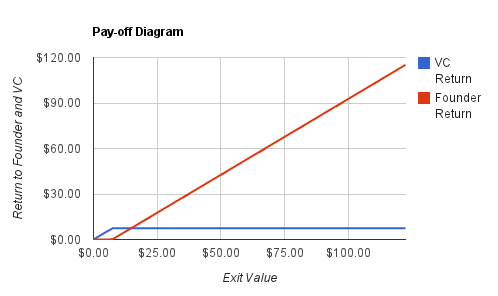

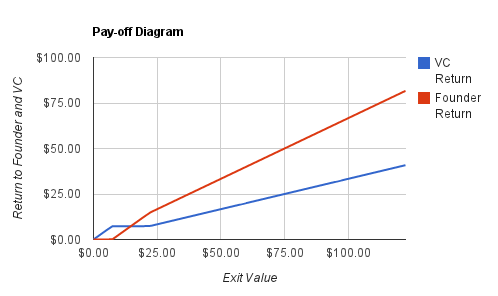

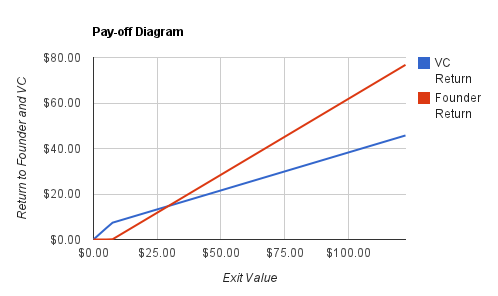

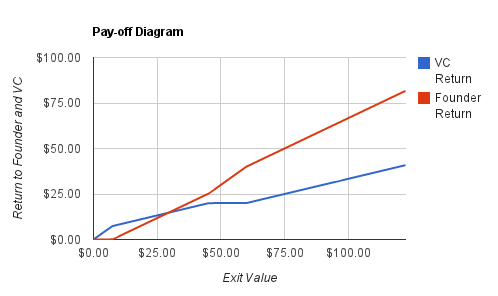

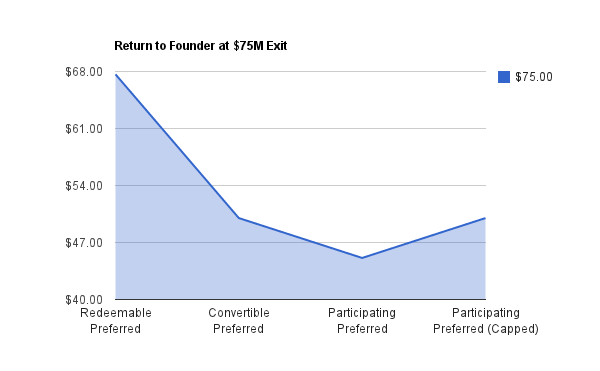

Third, calculate the common stock on an as-converted basis. You only need to fill in three cells: The current common stock outstanding (D12) PLUS the number of shares issued (D13) and the convert-to-common ratio (D14) of the funding raising event. Fourth, what is the dividend rate (K12)? And is the dividend Cumulative or Accrued (K13)? Accrued means that outstanding dividends are simply paid back; for example, if $5M of preferred are issued and the rate is 8% and an exit occurs 5 years out, than the dividends due to the investor are $2M ($5M x 8% x 5 yrs). Cumulative means that the dividends are compounding. Using the same example, the investor would receive $2.35M in dividends plus principal (5M x 1.08^5). Cell K14 is only relevant to Participating Preferred Capped. Caps are usually a multiple of the investment. So a $5M investment with a 4-times investment cap means that the investor can participate up to $20M. If the investors share of the exit exceeds the capped amount, the investor will convert to common and realize the upside. Lastly, what is the expected time to exit (K9)? This is vital to calculating the dividends due. The Results: Same Variables, 4 Security Types For each security type, we'll assume the company is raising $5M. There are 20M shares outstanding and the company is issuing another 10M on an as-converted-to-common basis. Thus, the founders own 66 2/3 and the investors 33 1/3. Dividends are cumulative and pay a rate of 8%. An exit is expected in 5 years. Remember, the tool is flexible so plug in the terms relevant to your deal. I. Redeemable Preferred Redeemable preferred act just like debt, in that the investor is entitled to principal plus dividend but no upside. For this reason, it is highly unlikely that an early stage investor would accept RP. As you can see from the diagram below, the RP holder receives all the proceeds of the exit up until $7.35M. So in the event of a $50M exit, the investor receives $7.35M and the founders $50-7.35=$42.65M. II. Convertible Preferred Convertible preferred give the investor the option to convert into common stock. Using our example, the investor will convert to common at a $22.50M exit. Why? Because 33 1/3% of $22.5M is $7.50M, which is greater than $7.35M from principal plus dividend. III. Participating Preferred Participating preferred are commonly used by early stage investors. PP give the investor the best of both worlds: they receive dividend plus interest AND also participate in the remaining upside. So, in the event of a $50M exit, the investor will receive $5M in principal plus $2.35M in cumulative dividends. But that is not all. They will also receive an additional $14.21 [$50M-$7.35M)*33 1/3]. The grand total: $21.56M. IV. Participating Preferred (Capped) Participating Preferred with a cap are similar to PP but, well, with a cap. Caps usually refer to some multiple of the original investment. In this example, let's assume the cap is 4x, i.e. 4 x $5M or $20M. This means that the investor can participate up to $20M. Thus, an exit between $47.5M and $60M will yield $20M. (You can see this plateau in the graph below.) An exit above $60M translates to a common stock value above $20M ($60M x 33 1/3). Therefore, the investor will convert to common and realize the upside. (Again, you can see the upwards slope at $60M). Conclusion

Security types and terms matter - a lot. Assuming a $75M exit, the founder that sells redeemable preferred will receive $67.65M. The same exit size but using participating preferred results in $45.10M. Hence, the type of security equates to a $22M difference on a $75M exit. In short, model out your term sheet before signing anything. The attached model should be applicable for a large majority of sheets. If your sheet has more nuances, try building your own. And don't be afraid to contact me; always happy to help. |

JONATHAN STEIMAN

I'm the Founder and CEO of Peak Support. This blog is my take on early-stage companies and innovation. Every so often, there may be a post about culture, networking, family -- you name it. After all, what is a blog if it isn't a tad bit unstructured.

Archives

December 2016

Categories

All

|