|

I spent this past President's Day weekend with my family in Massachusetts. For the last few months, I've been reflecting on entrepreneurship and innovation, and have drawn the following conclusion: It's a golden era. Just when you think there won't be another blockbuster, two-year old Groupon tells Google to take its $6 billion and scram. I was surprised, therefore, to hear my family's dismal, pessimistic outlook. Why the disconnect? Is it because my father had not been reading TechCrunch, but rather the local news which focused on the housing market and retirement funds duped by Bernie Madoff? Or are we in a social/mobile/local bubble that is impairing my judgement?

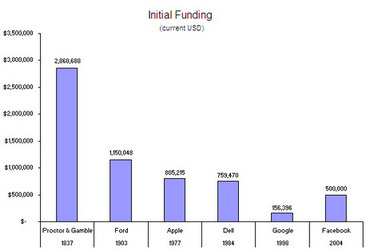

While I concede that the market may be a bit frothy, my conclusion largely stands: Entrepreneurship and innovation in the US is thriving. Thanks to cheap computing power, open source software, low cost telecommunications and digital distribution channels, the capital required to start a successful business is a fraction of what it was 5, 10 or 100 years ago. In 1837, Proctor & Gamble required an initial funding of over $7,000, which equates to $2.8 million today. Fast forward to the current millennium and Facebook, Google and the other great companies of our generation were all initially capitalized with a fraction of $2 million (see below chart). Furthermore, today's businesses scale much quicker. Facebook, for example, reached $2 billion in sales less than 6 years after its creation, an amazing feat considering that the company did not have a revenue model in the early years. Dell, on the other hand, had a clear revenue model and it took almost 10 years to reach the $2 billion mark. Media is another great example of scale. At its peak, the New York Times had a daily circulation of about 1.2 million. Today, Justin Bieber sends unlimited messages at no cost to 7 million followers on Twitter. The combination of low capital requirements and achieving scale quickly is having two effects on entrepreneurship. First, lower capital requirements means that a greater number of companies can become viable businesses with personal savings, friends and family money or angels. This is great for the founders because they are able to improve their company's valuation ahead of a traditional VC round. It's also giving rise to "super angels," or investors that are more flexible than old-line VC firms but more sophisticated than the traditional angel / accredited investor. Second, quick scale means more instant feedback on a company or a product. In the past, products were delivered through disconnected channels and advertisements were one-way. As a result, the feedback loop spanned many months and often did not provide great insights. Today, a company can receive instant feedback on a product, thus allowing it to quickly adjust its offering or messaging. Capital requirements will continue to fall and companies will continue to achieve scale at an accelerated pace. This maxim provides me great comfort. I would, however, be naive if I did not see the structural problems facing this nation. Our indebtedness, our educational system and our immigration policy are worrying. If we fail to address those issues, the very entrepreneurial landscape that I laid out above will be at risk. But those are topics for another day. Today, I'm going to visit an Apple store and soak in the wonders of today's innovations.

2 Comments

|

JONATHAN STEIMAN

I'm the Founder and CEO of Peak Support. This blog is my take on early-stage companies and innovation. Every so often, there may be a post about culture, networking, family -- you name it. After all, what is a blog if it isn't a tad bit unstructured.

Archives

December 2016

Categories

All

|